Mikhail Zinshteyn

CalMatters

A technical glitch is blocking students who are U.S. citizens — but whose parents aren’t — from completing their federal financial aid applications, and the problem is causing panic in California.

For many of these college applicants, it’s a crisis not only preventing them from applying for federal grants and loans, but also from applying for free tuition at the University of California and California State University or partial tuition waivers at private colleges in the state.

The deadline for that state aid is April 2 for new students, a date set by California law that only the Legislature and Gov. Gavin Newsom can change.

“It makes me feel worried,” said Ashley Estrada, a high school senior at Diego Rivera Learning Complex in south Los Angeles. Estrada is a citizen while both her parents are undocumented. She has a high GPA and aspires to attend UC Berkeley, UCLA, Dartmouth or another elite campus.

“I don’t know who to call,” said Estrada, whose parents earn little money. “Because I already talked to all the adults around me and everyone’s just telling me to wait, and they don’t have an answer for me.”

She has attended financial aid workshops but cannot complete the Free Application for Federal Student Aid, better known as FAFSA. She called the customer support line listed on the application, but the call disconnected, she said.

When parents without Social Security numbers try to fill out the application on behalf of their children, they get an error message that blocks them from continuing. Without the parental information, students cannot complete the FAFSA. California State University’s director of financial aid, Noelia Gonzalez, wrote in an email that U.S. Department of Education officials told the university that they “expect to have a fix prior to April 2.”

An Education Department spokesperson wouldn’t comment on the record about the matter.

The problem is new and emerged this year. Federal law only requires that the student applying for federal aid be a citizen or have permanent status, but in most cases that aid is calculated based on parents’ or a spouse’s income information.

The scale of the financial aid application fiasco

Likely tens of thousands of California students are unable to complete the FAFSA because their parents aren’t citizens, but a firm number is impossible to calculate, said Jake Brymner, a deputy director with the California Student Aid Commission, the agency that oversees the state’s $3.4 billion financial aid program. He noted that last year 108,000 students in California didn’t include their parents’ Social Security numbers in their FAFSA applications. That could be because the parents lacked one or they didn’t want to provide their numbers.

“I am from a low-income area and most of our parents are undocumented,” Estrada said. “I’m upset that we’re going through this.”

The typical low-income student caught in the federal technology imbroglio stands to lose as much as $14,000 in state tuition waivers known as the Cal Grant and $7,400 through the federal Pell Grant, plus the ability to borrow subsidized loans and other tools to afford college. Also on the line is a state scholarship worth up to several thousand dollars that also has an April 2 deadline.

“This is a major concern for the financial aid community across the country,” said Jose Aguilar, the financial aid director for UC Riverside.

Possible state grant fix

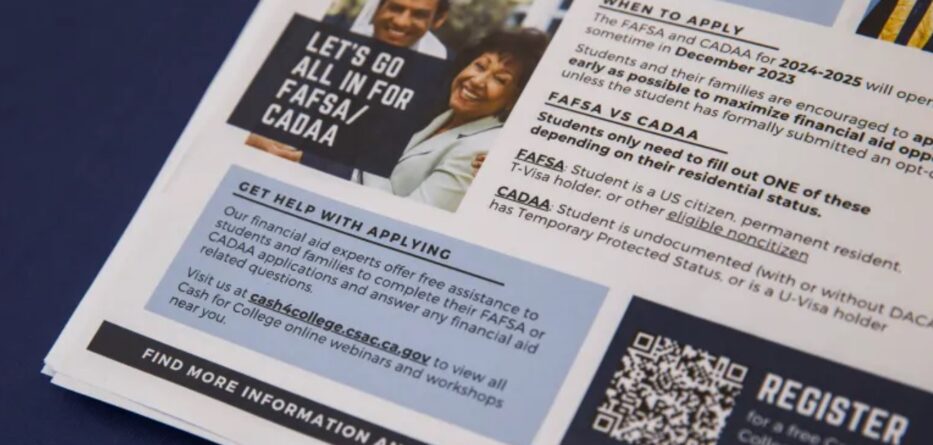

While state policymakers cannot do anything about students locked out of federal aid, the state’s student aid commission is considering a workaround for accessing state grants and scholarships. The idea is to permit affected students to complete the state financial aid application reserved for undocumented students and other non-citizens who aren’t eligible for federal support. That form is called the California Dream Act Application, one that tens of thousands of undocumented students already use. The commission does not share information in the Dream Act application with the federal government or with immigration authorities.

The aid commission is conferring with state universities about this proposal. But that fix will “create a lot of confusion for these students,” said Aguilar. He is worried that if the students whose parents don’t have Social Security numbers complete the Dream Act application, they won’t realize they’ll also have to submit the FAFSA when the Biden administration fixes the problem.

“In many cases these students might end up not receiving the full aid they are eligible for,” he said.

Both he and Cal State’s systemwide director of financial aid, Gonzalez, said the state should extend the deadline for the Cal Grant. Aguilar added that the student aid commission could also identify students who missed the Cal Grant deadline because their parents aren’t citizens and allow them to submit an appeal.

Gonzales didn’t weigh in on whether it’s a good idea to open the Dream Act application to citizens whose parents aren’t. But if that happens, she would want the student aid commission to contact those students to “submit a FAFSA as soon as the process is available.”

Enrollment worries

While some wealthy private colleges can probably provide students financial aid packages to make up for any loss in federal or state support, most students rely on public dollars to afford their education.

Students who start school this fall will have until June 30, 2025 to submit their FAFSA applications for the 2024-25 academic year. By then, the federal government is likely to find a solution, said Cal State’s Gonzalez. Some in the California financial aid community fear that if these mixed-status students don’t get their federal aid processed by the time school starts, they won’t enroll.

“That is a concern,” said Aguilar of UC Riverside. “Our staff will be trained to be sensitive to this student population, encouraging them to complete the FAFSA.”

If no fix emerges before students enroll this fall, Aguilar’s plan is to temporarily cover the loss of the Pell Grant with UC’s internal aid. The university will give students deadlines to complete the FAFSA once the problems with it are fixed. If students don’t complete the FAFSA, they will be stuck with a bill equal to the amount in Pell money UC Riverside provided.

“I want students that are going through the same experience as me to know that if we speak up, maybe we’ll get an answer.”

ASHLEY ESTRADA, HIGH SCHOOL SENIOR IN SOUTH LOS ANGELES

To him, a larger issue “is that these students will lose out on federal work-study and federal student subsidized loans,” for 2024-25 if they cannot complete their FAFSA by the start of the fall term, he said. While his office can backfill a Pell Grant temporarily, he cannot do that with loans, which students with slightly higher parental incomes rely on to pay for housing and other expenses.

“I don’t believe there is enough information out there to help the thousands of students who need that support in the class of 2024,” said Erica Rosales, who runs College Match, a program that identifies low-income high school students with high GPAs in the Los Angeles area and prepares them to apply for the nation’s top colleges. Estrada, the Los Angeles student, is a College Match member.

Marcos Montes is a policy director for the Southern California College Attainment Network, an umbrella group of nonprofits. He was helping a student and her undocumented mother apply for FAFSA, to no avail. The student grew frustrated that she may not qualify for any financial aid.

Montes tried to instill hope. “I just had to relay my message that this is a temporary problem,” he said. His message to that family was “don’t give up on those thousands of dollars of financial aid that you’re eligible for.”

Other FAFSA problems

The current problem is the result of changes that the U.S. Department of Education made to FAFSA late last year to simplify it for parents and students. But the overhauled form, a response to recent federal laws, has wreaked havoc on a wider scale for different reasons, causing headaches for the Biden administration and colleges.

The new FAFSA debuted months later than the application start date in past years. Colleges will only start receiving students’ financial aid information from the Education Department in March, also months later than normal. That’ll create a huge bottleneck for colleges that have to analyze the financial information of thousands of admitted students and then send them individualized financial aid packages by late spring. The department is spending tens of millions of dollars to assist colleges in processing the applications.

Typically, students must commit to enrolling at a school by May 1, but the delay in getting students’ financial aid information to colleges is forcing many campuses to push back that deadline. Students too will be in a rush to compare financial aid award letters under a compressed schedule, a time typically reserved for calling campuses and seeking clarification before they pick the school they’ll attend.

The UC and Cal States will now allow students to confirm their enrollment by May 15, and some Cal States may push back the deadline even more. By then, students like Estrada hope to know what their financial aid packages will be.

“I want students that are going through the same experience as me to know that if we speak up, maybe we’ll get an answer,” Estrada said. The answer she seeks? “We’re gonna get the aid, you know, we’re gonna go to college.”