Nathaniel Sillin / Practical Money Matters

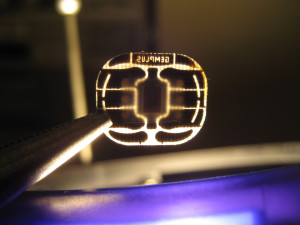

If you’ve received a replacement for your credit or debit cards in the mail lately, take a closer look. That little gold chip on the front is going to make it tougher for thieves to steal your data.

By year-end 2015, Visa estimates that 63 percent of cards in American wallets will feature this new technology (www.VisaChip.com) aimed at derailing counterfeit fraud. The new chip adds a unique, one-time code that changes every time you use your card to make an in-store payment. That automatic security code change makes your data nearly impossible to use to create a counterfeit card.

Counterfeit or “cloned” cards account for about two-thirds of in-store fraud to the tune of $3 billion, according to Boston-based research firm Aite Group. The transition to chip cards is expected to be nearly complete by year-end 2017.

You’ll see very slight differences in using these cards. First, you’ll need to insert a chip card into a new slot on built for chip cards and keep it there until your purchase is complete. You won’t have to swipe traditional magnetic strip on the back anymore. You will still be able to sign, enter a PIN or just pay-and-go for everyday transactions as before. Just remember to take your card with you when the transaction is complete.

However, if you are currently using an old but unexpired card or if the business where you’re doing a transaction doesn’t have the upgraded chip card equipment, don’t panic. The strip on the back of your card will continue to work with all card terminals for the foreseeable future.

For merchants – the collective name for the stores, restaurants and other businesses where you use credit and debit cards every day – the transition to chip cards is moving along as well. According to a recent survey by Visa, approximately 90 percent of business owners are aware of chip technology and about 70 percent have already upgraded their equipment or have plans to do so. Current estimates show that 47 percent of U.S. terminals will be able to read chip cards by the end of the year.

There’s one more incentive for all businesses to get on board with chip card technology: Starting October 1, liability for some counterfeit fraud may shift from the card-issuing financial institutions to retailers unless they are able to accept and process chip card transactions.

For merchants, processing chip transactions will likely involve a hardware or software upgrade somewhat similar to upgrading a cellphone contract. In many cases, the terminal will be included in the cost of the service. About a third of merchant terminals are already chip card-capable and just need a software update to fully function.

For the smallest businesses, some low-cost options for upgrading card acceptance terminals can cost $100 or less. Square https://squareup.com/contactless-chip-reader, for example, recently announced a new $49 card reader that accepts chip cards as well as mobile payments and they’re giving away 250,000 of them to small business customers at no cost.

If you travel overseas regularly, you’ve probably already seen chip card technology in action. It’s based on a global standard called EMV and is already at work in countries moving to cashless options for private and public goods and services.

One final note. While you’re waiting for your new chip cards, you’ll still be able to use your current strip-based credit cards in new machines under their zero liability fraud protection rules. However, debit card security rules are different, so it is best to check with your bank on their guidelines so you know your funds are secure.

Bottom line: The move from strip to chip cards will create a more secure environment for credit and debit card users. However, consumers will still need to keep their cards safe and confirm the accuracy of all their spending data.

Nathaniel Sillin directs Visa’s financial education programs. To follow Practical Money Skills on Twitter:

www.twitter.com/PracticalMoney

�